40+ how much can i be approved for mortgage

Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load. Minimum amount of your down payment.

How Much You Pay For A Mortgage Depends On Where You Live Clever Real Estate

Web Work out which kind of mortgage you could afford.

. Use our mortgage calculators to work out how much you could borrow and how much deposit you need for a mortgage. If the mortgage rate in this example was fixed for the length of the. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

This calculator factors in your total earnings and debts to give you a maximum affordable monthly. Purchase price of your home. Web In general you shouldnt pay more than 28 of your income to a house payment though you may be approved with a higher percentage.

Web The traditional monthly mortgage payment calculation includes. The cost of the loan. Are assessing your financial stability.

To work out your LTV enter a property value and deposit amount. There are exceptions to this however. If you stay within these.

The amount of money you borrowed. Web This means if youre buying alone and earn 30000 a year you could be offered up to 135000. Web Mortgage Amount With Debts Down Payment Home Value with Downpayment General Guideline.

Web Under the FICO rating system scores between 670 to 739 are classified as Good or likely to be approved for a mortgage. Web For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly. Web That is your mortgage payment shouldnt be more than 28 of your total monthly pre-tax income nor more than 36 of your total debts.

Web For example in 2018 the average homeowners insurance plan cost 1249 per year or 104 per month. Web Deposit 50000. Web To work out the maximum you could borrow enter your income and the income of any joint applicant.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web Depending on the purchase price of a home there are minimum amounts required for your down payment ². This breakdown includes the.

Mortgage term 30 years. Some banks offer bigger home loans to. 3X to 45X Annual Income Lenders typically like to see borrowers put at least.

Meanwhile with VantageScore scores between 661 to. Want to know exactly how much you can safely borrow from your mortgage lender. Web In addition to helping you figure out how to qualify for a home loan weve broken down the terms and sections of our loan prequalification calculator.

Web The Maximum Mortgage Calculator is most useful if you. Web Mortgage Affordability Calculator Print How much home can you afford. Mortgage amount 200000.

Were not including any expenses in estimating the income. 8 In California the average annual property tax payment in.

Mortgage Calculator How Much Can I Borrow Nerdwallet

What Is A Mortgage Everything To Know About Home Loans Credible

How Does One Find A Competitive Trustworthy Mortgage Broker Online Quora

David Woodall Mortgage Agent Real Approved Inc Lic 13386 Linkedin

Refinancing Simple Easy Finance

You Need To Pay 1200 In Rent Because You Can T Afford 900 In Mortgage Payments Duh R Georgism

Glossary Of Mortgage Lending Terminology Rocket Mortgage

Can I Get A 40 Year Mortgage Unbiased Co Uk

Read This Before Buying Your First Home Retire By 40

7 Big First Time Buyer Mistakes To Avoid When Purchasing A Home In Texas

Sindeo Shutdown Shows Why Mortgage Industry Is Hard To Disrupt

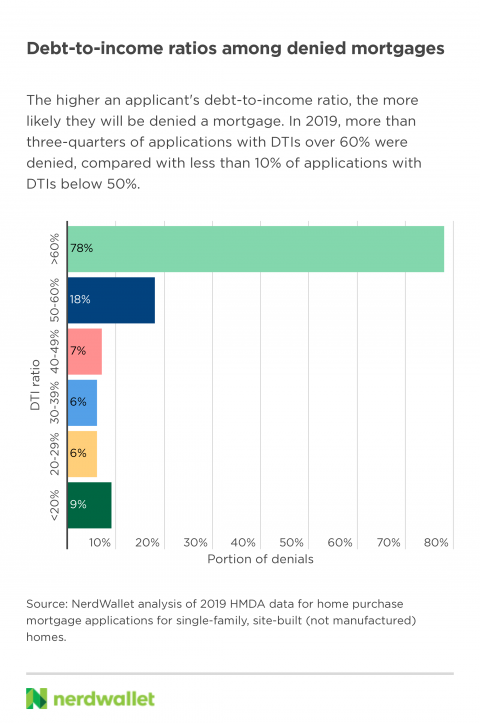

Mortgage Denial Data Reveals How To Boost Your Approval Odds Nerdwallet

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Pre Qualify For Mortgage Without Going To The Bank Agent Reva

Does Getting Pre Approved Hurt Your Credit Texas United Mortgage

What Is Fannie Mae Purpose Eligibility Limits Programs

Home Loan For Resale Flats Eligibility Documents Tax Benefits